salt tax deduction changes

Child Tax Credit. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate.

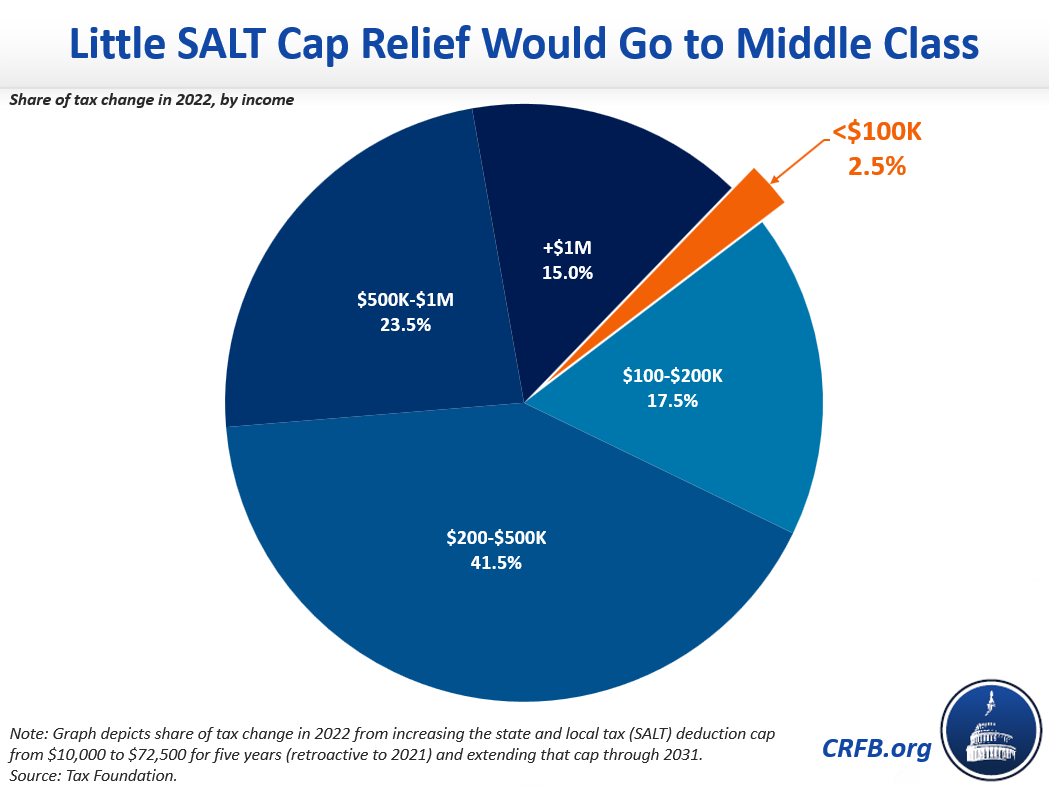

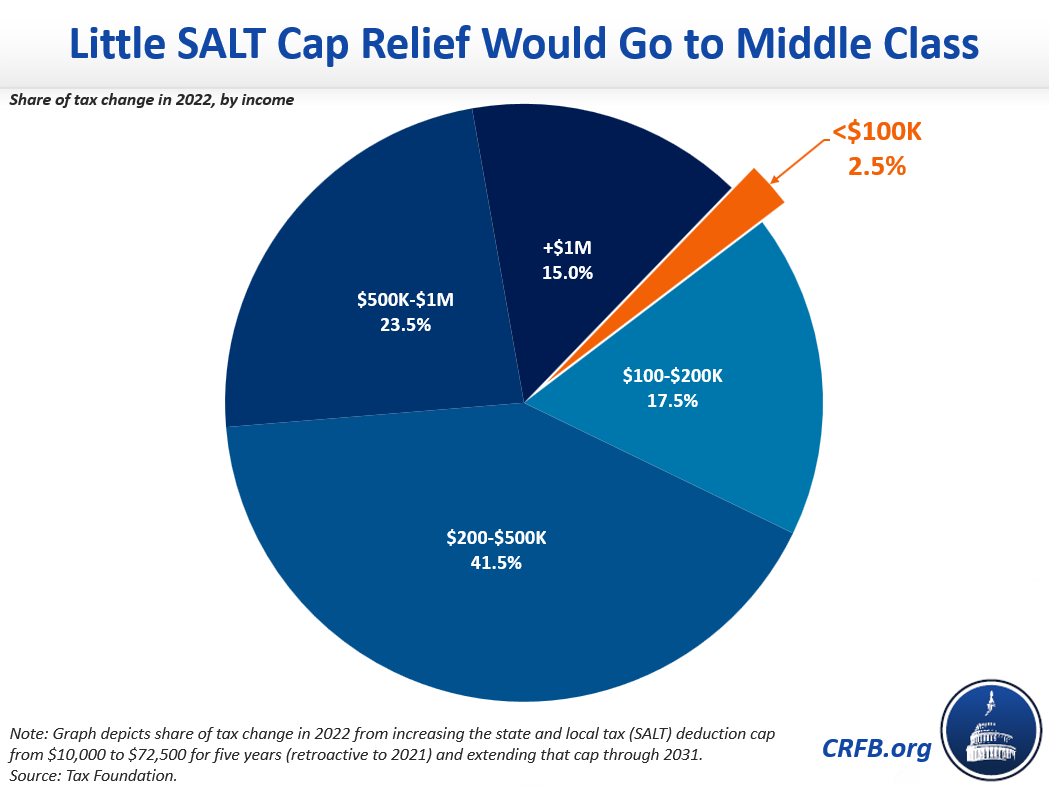

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

The cap is currently scheduled.

. House Democrats on Friday passed their 175 trillion spending package with an increase for the limit on the federal deduction for state and local taxes known as SALT. Single and married taxpayers are limited to the same 10000 deduction. Four states New York Connecticut Maryland and New Jersey have brought a lawsuit against the federal tax bill the Tax Cuts and Jobs Act TCJA claiming that its 10000.

Ways Means approves a temporary repeal of the SALT deduction cap. The Tax Cuts and Jobs Act. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

By Sahil Kapur. At the end of the day we. Reduced SALT and State Tax Changes.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. If the standard deduction was used OR the itemized amount deducted is less than 24000 the new standard deduction under the tax code the SALT deduction change likely. Missing SALT tax break complicates path for Manchin and Schumers tax and climate change deal Some Democrats are furious that the bill does not restore the State and.

In an unsurprising near party-line vote the House tax writing panel. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. This significantly increases the boundary that put a cap on the SALT.

Credit per dependent child ages 6-17. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. The change may be significant for filers who itemize deductions in high.

Credit per dependent child under 6. WASHINGTON Democrats are considering changing the law to let Americans deduct more state and local taxes from their federal returns as part of a major. Child dependents who are 17 years.

The SALT deduction limit was part of a larger change to the individual income tax. Republicans passed the 10000 SALT deduction cap as part of their 2017 tax law as a way to help offset the cost of tax cuts elsewhere in the bill. The cap on the SALT deduction has been a body blow to New York and middle-class families throughout the country Suozzi had said at the time.

The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. 2021 rules going away. New limits for SALT tax write off.

The TCJA lowered tax. During negotiations in the Senate on the 737 billion spending bill Republicans like South. 52 rows The SALT deduction is only available if you itemize your deductions.

The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025. In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap set to expire.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Changes To Federal Salt Deduction Expose Illinois High Taxes

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

N Y Salt Charitable Contribution Plan Fizzles Out Yonkers Times

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

How To Deduct State And Local Taxes Above Salt Cap

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People Tax Policy Center

House Prepares For Reconciliation Vote Without Salt Relief

Coping With The Salt Tax Deduction Cap

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy